CFMS Citizen Challan AP Creation on Citizen Portal

A Citizen Challan is an official document generated through the CFMS Citizen Portal that acknowledges the payment of government-related fees, taxes, or other charges. The challan serves as a proof of payment and is used across various departments for accounting and record-keeping. Cfms.ap.gov.in citizen services portal is used for creation of citizen CFMS challan.

Uses of CFMS Citizen Challan AP

- Paying vehicle tax, professional tax, or other services tax.

- Fees related to permits, licenses and other applications.

- Paying traffic penalties, fines or court-imposed charges.

- Government-related services such as land registration, utility bills, or tender fees.

Table of Contents

Step-by-Step Guide to Creating a CFMS Challan

Follow these steps to generate a CFMS Citizen Challan through the official CFMS Citizen Portal:

Access the CFMS

Open your preferred web browser and visit the official CFMS Portal.

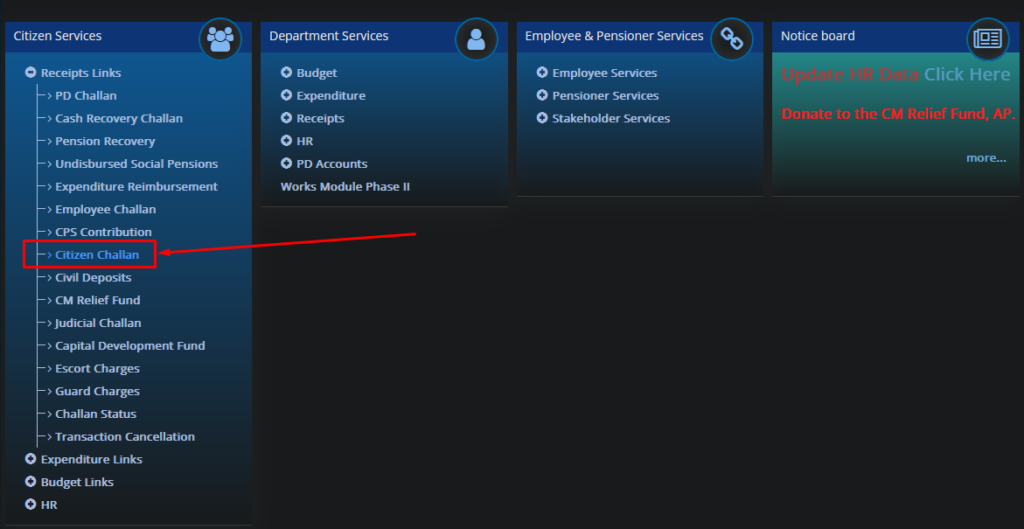

Navigate to Citizen services -> Receipts Links -> Citizen Challan

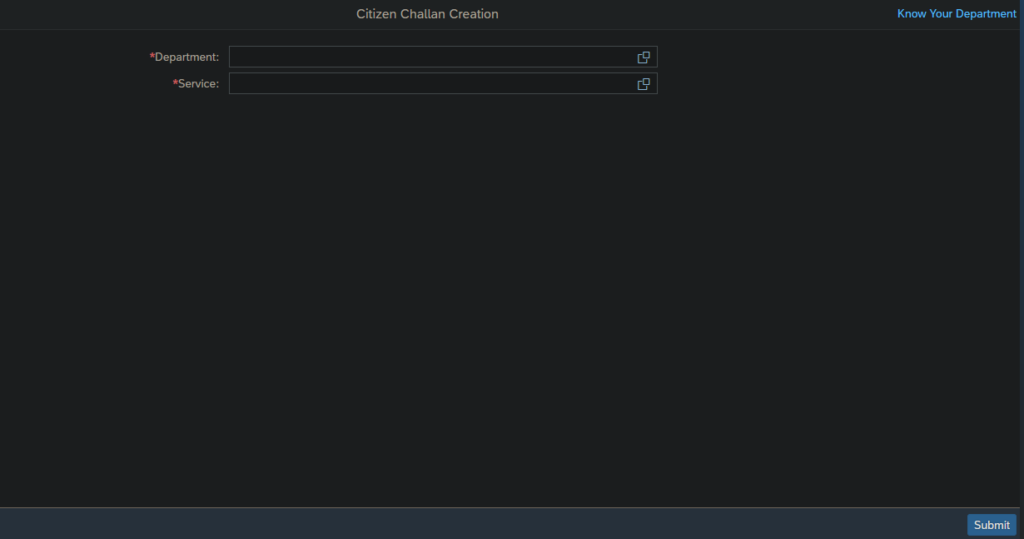

AP Citizen Challan Creation Form

On Clicking on above Citizen Challan menu a link (https://prdcfms.apcfss.in:44300/sap/bc/ui5_ui5/sap/zfi_rcp_challan/index.html?sap-client=350) will open with the challan creation form.

Fill up the Form

- On opening the form there are 2 required fileds displaying naming “department” and “services”.

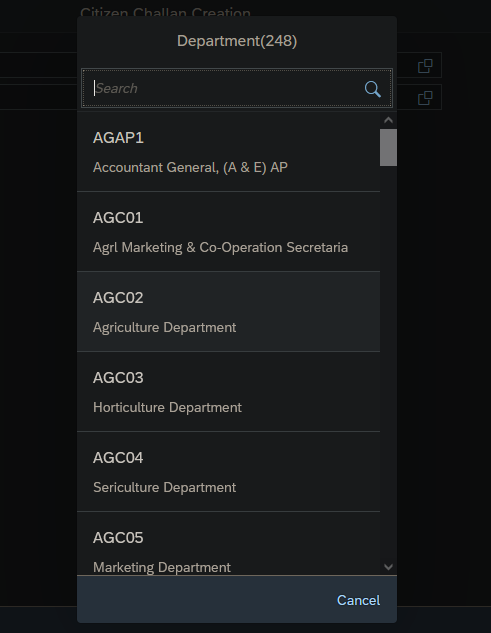

- On clicking on department text box a model will open with available department lists.

Select your related department for which you want to generate the AP citizen challana.

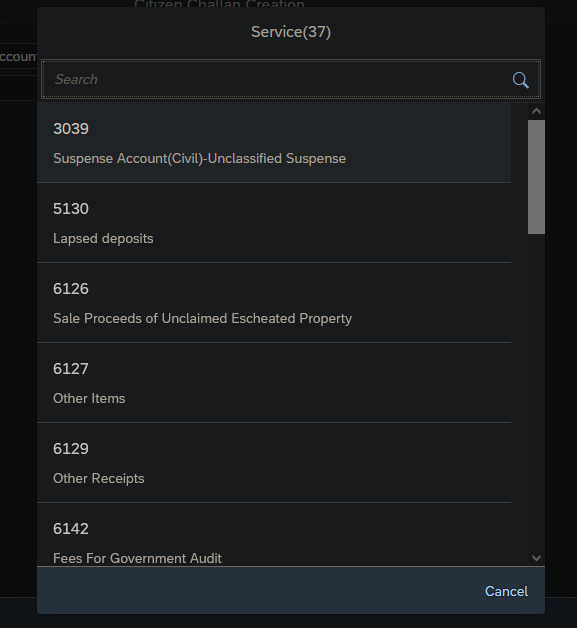

- Now select the service text box and available CFMS services list will open.

Select the service for whic you want to create Challan.

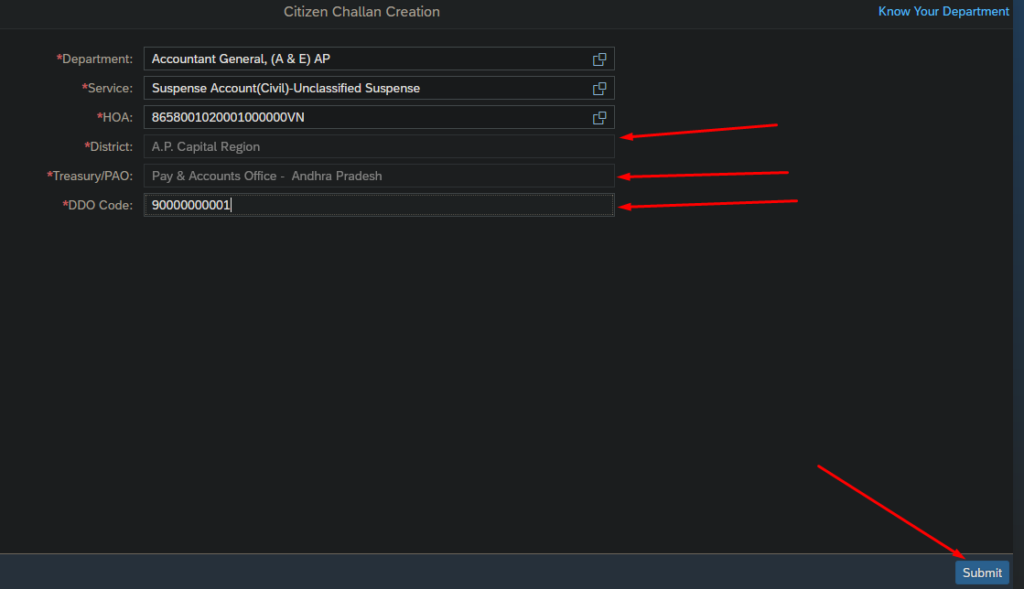

- On choosing the service, 4 more fileds (HOA, District, Treasury/PAO, DDO Code) will display on the form. These fields are ready only, you have to do nothing with them.

- Now submit the form

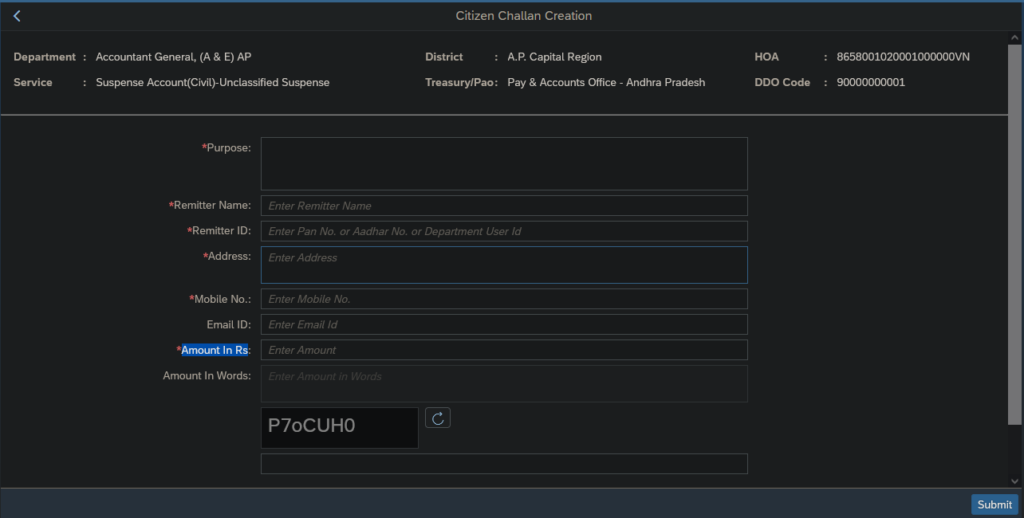

Further Details for Citizen Challan Creation

On submitting the above details a new form will show up with fields Purpose, Remitter Name, Remitter ID, Address, Mobile No., Email ID, Amount In Rs and a captcha to fill up.

Fill up all required fields according to your concern.

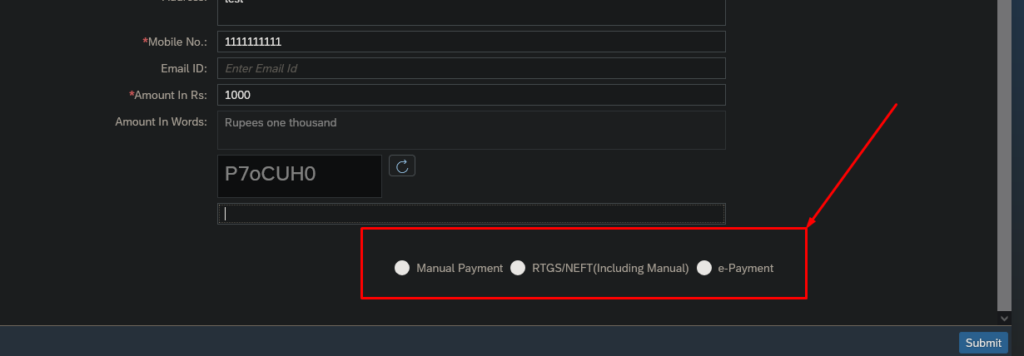

On Filling all required fields payment metods options will display bellow the form.

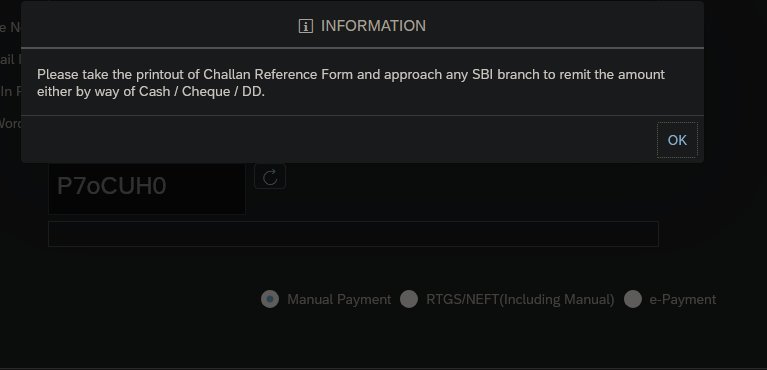

On selecting the Manual Payment of Citizen challan Follwing in formation will display.

Click on OK and fill up the captcha and submit the form.

Great, your Citizen challan is created and Challan cfms Transection ID and Bank Reference will be displayed.

Print this and Visit the bank to pay the Challan.Here is the method to track the Citizen Challan Status on Official CFMS Citizen Portal.

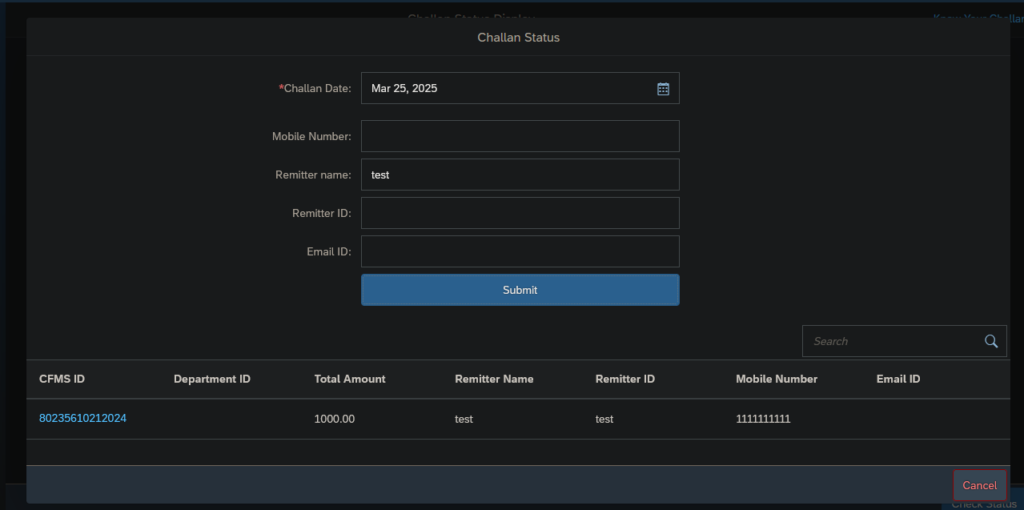

After successfull citizen challan creation you will able to see it’s status on the Challan status page from CFMS citizen portal.

If some Incorrect information is entered in Challan the you can cancel the challan and generate a new one.

Steps to Cancel CFMS Citizen Challan

- Visit the official CFMS portal

- Navigate to Citizen Services -> Receipts Links -> Transaction Cancellation

- Fill in Transaction ID and submit the form to cancell the Challan.

Note: Only ePayment Challans can be cancelled from here.

Direct link to Officail CFMS for Challan cancellation

Common Issues and Solutions While Generating a CFMS Citizen Challan

- Incorrect Payment Details

Solution: Always double-check the details before submitting the form. If a mistake is made, cancel the challan and generate a new one. - Payment Failure

Solution: Wait for a few minutes and try again. If the issue persists, contact the respective bank or CFMS helpdesk (Guide here). - Challan Receipt Not Generated After Payment

Solution: If you paid online but the receipt is not generated then you can confirm the Citizen Challan status by visiting Official CFMS Citizen Portal and follow the steps to check CFMS Citizen Challan Status. - Unable to Access CFMS Portal

Solution: Clear your browser cache or try accessing the site at a later time when the server load is lower.

Frequently Asked Questions (FAQs)

Can I generate a CFMS Citizen Challan without registering on the portal?

Yes, some challan services allow guest users, but registered users get additional benefits such as payment history tracking.

How long is a generated challan valid?

The validity period of a CFMS Citizen Challan varies depending on the department, usually between 7 to 15 days.

What should I do if my challan payment is unsuccessful?

Try again after some time. If the issue persists, contact the CFMS support team with your transaction reference number. Helping articale here.

Can I modify a generated challan?

No, once a challan is generated, it cannot be modified. You need to create a new one if any changes are required.

Is there a mobile app for the CFMS Citizen Portal?

Currently, CFMS services are primarily web-based.

Conclusion

Generating a Challan through the Portal is a simple and efficient process that allows citizens to make government-related payments quickly and securely. By following the step-by-step guide outlined in this article, users can avoid errors and ensure successful transactions.