What is CFMS Challan?

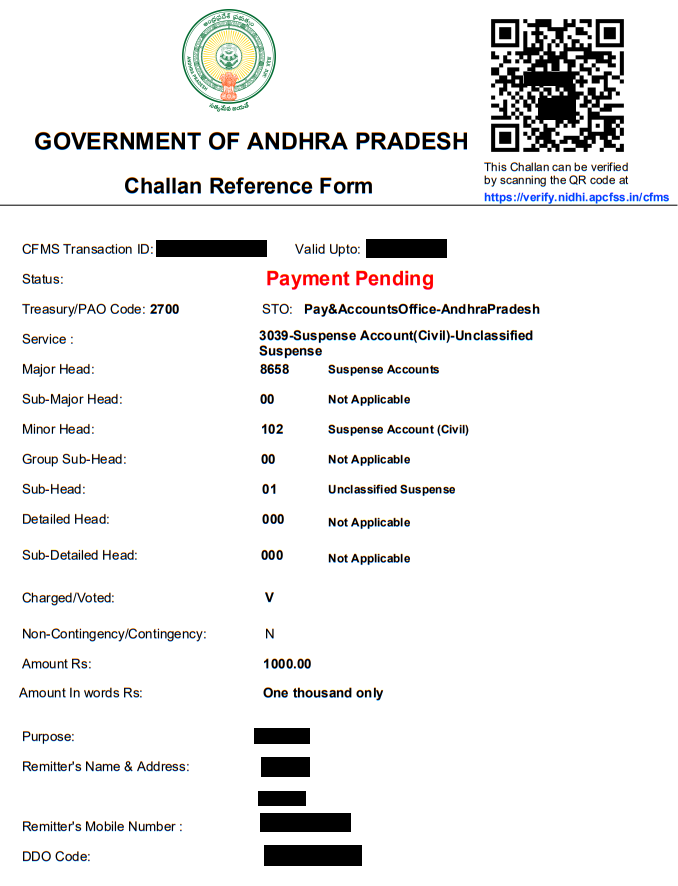

A CFMS Challan is an official document issued when payments are made to the government through the CFMS portal. It serves as proof of payment for taxes, fees, penalties, and other government services.

Importance of CFMS Challan

- Made secure and transparent payment records.

- Allows online and offline payment methods.

- Enables users to check challan status anytime. Method to Check Challan Status

- Serves as an official record for tax and financial audits.

- CFMS portal saves time to visit offices for creation and payment of challan

Table of Contents

Types of CFMS Challans

There are 4 major types of challan.

- Tax Payment Challan – Used for paying taxes like GST, property tax, etc. also known as Citizen challan at cfms citizen portal.

- Fine Payment Challan – Used for penalty or fine payments imposed by government authorities.

- Departmental Challan – Used by government departments for inter-departmental transactions.

How to Generate a CFMS Challan

Short outline for the method of CFMS challan creation is here. For detailed method of challan generation you can visit How to generate Citizen CFMS Challan.

- Visit the CFMS Portal

- Navigate to the Challan Section

- Fill in Basic Details on Challan Generation form

- Fill Further details on challan creation including challan amount and challan purpose

- Choose the Payment Method

- Generate and Download Challan

- Pay Challan

- Confirm Challan Status

How to Pay a CFMS Challan

Once the challan is generated, it must be paid using one of the following methods:

Online payment / E-Payment

Challan can be paid by the following online sources which can be selected on the end screen of challan creation :

- Net Banking

- Debit/Credit Card

- UPI Payment

Bank Payment / Offline

Challan can also be paid manually by visiting related bank. For this you will need to follow these steps:

- Take a printout of the generated CFMS Challan for which you selected payment type manual.

- Visit an authorized bank and deposit the amount.

- Obtain a receipt as proof of payment.

Latest Articles:

- IFSC Code For State Bank of India SBI

- Bank Baroda IFSC Code List

- What is CFMS Challan?

- How to Download Salary Slip from CFMS ESS?

- CFMS Citizen Challan AP Creation on Citizen Portal

Frequently Asked Questions

What is the validity of a CFMS Challan?

Validity of each challan is mentioned on the challan as Valid Upto date.

Can I modify a generated CFMS Challan?

Generated challan cannot be modified but you can create a new one.

How long does it take for a CFMS Challan payment to reflect?

It can be updated in an hour but if it is not updated even after 24hr of business days then you should contact the CFMS helpdesk for follow up issue. Check some tips to solve issue professionally.

Is CFMS Challan applicable for all government transactions?

Yes, CFMS Challan covers various transactions, including tax payments, fees, and fines. For further confirmation you can ask the related department officer.

What should I do if I lose my CFMS Challan receipt?

You can re-download it from the CFMS portal using your Challan Number. Helping guides: Know your CFMS transaction id, CFMS Challan status

Result

The CFMS Challan system provides a easy and convenient way to make payments to the government electronically. Whether paying taxes, fines, or department fees, the CFMS portal ensures quick and secure transactions. Understanding how to generate, pay, and track a CFMS Challan is essential for a smooth financial transaction process.